10 Accounting Tips for Small Business Owners 2023

Cash accounting records revenue and expenses when you receive or spend money. Accrual accounting records revenue and expenses a transaction of goods or services happens. The two key accounting systems are cash accounting and accrual accounting. If your business is still small, you may opt for cash-basis accounting. If you carry inventory or have accounts payable and accounts receivable, you’ll likely use accrual accounting.

A Guide to Managerial Accounting

- They know about trade laws, foreign currency rates, and the accounting principles of other countries.

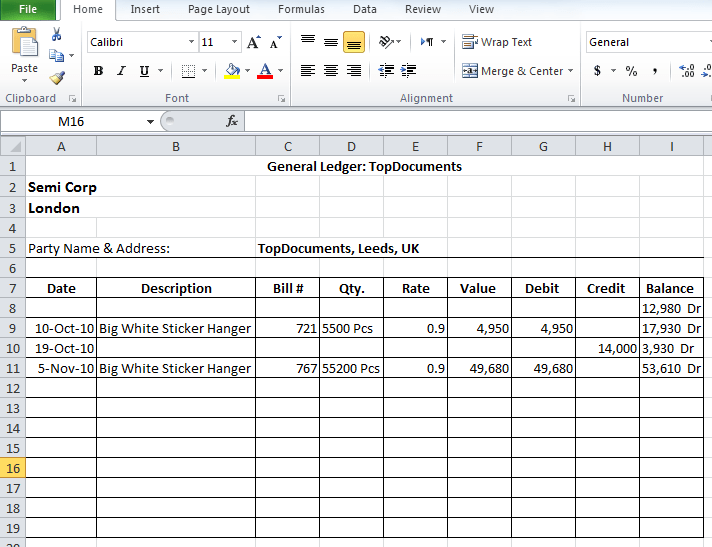

- Once the adjusting entries are made, an adjusted trial balance must be prepared.

- Do adequate due diligence before taking on any external funding.

Having separate individuals responsible for different accounting duties can improve your company’s efficiency. Accounting practices are a set of rules, procedures, and standards that govern the recording and reporting of financial transactions. A business owner must stay on top of sales tax laws in the states where they operate or sell.

Streamline your accounting and save time

Once you’ve chosen your bank, you can set up a new account quickly and easily. Your business bank account will allow you to set up a debit card for any online payments or purchases. These tools are how most small businesses manage their accounting, often supported by other important business software solutions, like a CRM or automation tools.

Useful Accounting Tips for Small Businesses

Single-entry accounting records all of your transactions once, either as an expense or as income. This method is straightforward and suitable for smaller businesses that don’t have significant inventory or equipment involved in their debt-to-equity ratio – d/e definition finances. It doesn’t track the value of your business’s assets and liabilities as well as double-entry accounting does, though. When setting up accounting for startups, you need to choose a method of recording financial transactions.

Automate invoicing

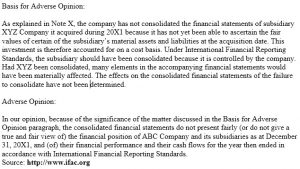

You’ll need to comply with both federal regulations and the states in which you operate your business. If you studied business, you know that accounting is more than staring at balance sheets all day. There are many different types of accounting that require different skill sets.

Paying yourself a regular, repeatable salary helps you keep the business on an even keel. Brett Larkin, the founder and CEO of Uplifted Yoga, believes this will make your life so much easier than constantly using your business account to pay personal expenses. “It makes it simpler to stay within budget, less stressful to track, and it reinforces the all-important idea that your business and personal accounts are entirely separate,” he said. And your relationship with your accountant and bookkeeper doesn’t need to revolve around tax time either.

Forensic accountants are using their knowledge to audit organizations for financial misconduct. Manage your business and personal finances with these five financial planning templates. If the IRS finds that you don’t have all receipts necessary for your business (from $75 and more), you can get penalized. As a result, you can experience gross income deductions before calculating the tax bracket. Keep records of your business transactions for 6 years if you don’t report income and if the income represents over 25% of your return gross income.

Regular financial reviews empower businesses to identify patterns, trends, and potential issues early on, enabling proactive decision-making to optimize resources and mitigate risks. However, like receipts, you should keep them as they can save your company in case of number mismatches and serve as legal protection if things go south. Moreover, receipts are also vital when it comes to doing taxes or in case of an audit. Compliance with laws is something to worry about when running a business. As laws and regulations constantly change, ensuring your company does everything by the books is essential. For example, if you prepare and post an invoice in the amount of $150 to John Brown for consulting, you’ll need to record that information in a journal entry.

Make sure you open a business bank account for your business expenses and do private bank account transactions on personal accounts. Consider getting a separate what’s wrong with the american tax system credit card to pay for business expenses. This will help you track the business-related expenditure and separate it from your personal finances.

Tracking your AR, usually with an aging report, can help you avoid issues with collecting payments. Understanding your AR can also help you set efficient credit terms for your customers. Delayed client invoices can also make businesses too dependent on bank financing or shareholder capital funding, which can further impact their finances. As a direct fallout of COVID-19, more than 54% of businesses are struggling with delayed invoice payouts. Having an apportioned salary for the business owner is an accepted business practice that helps you reinforce the business’s distinct and legal standing. Additionally, business owners are likely to be unaware of the federal, local, and state laws and legal regulations required for business.

Whether you’re an employee or the owner, you should be on the company’s payroll if you work for a company. If you want to expand your business globally or work with companies in other countries, working with an international accountant can help you take advantage of opportunities overseas. There are a few things you need to do in order to get started bookkeeping for your business.

We highly recommend that you work with a professional to at least ensure your business is following the proper procedures and laws. Independent contractors include freelancers, consultants, and other outsourced experts who aren’t formally employed by your business. With contractors, you don’t pay benefits or withhold taxes on their behalf. Technically, you should be doing it every day, but we all know life can get in the way. Ideally, you should complete your bookkeeping every month so you can keep a thumb on the pulse of your income, expenses, and overall business performance. Some companies decide to combine operating (OPEX) and SG&A expenses, while some separate them (they can be combined on an income statement).

QuickBooks Live Expert Assisted can help you streamline your workflow, generate reports, and answer questions related to your business along the way. One of the most important aspects of financial transactions is recording reconciliation in account definition purpose and types them accurately. This involves keeping track of all the money that comes in and out of a business. Financial transactions are business activities that involve money, such as sales, expenses, and payments.

Bookkeeping is the backbone of your accounting and financial systems, and can impact the growth and success of your small business. It encompasses a variety of day-to-day tasks, including basic data entry, categorizing transactions, managing accounts receivable and running payroll. “Not establishing a business bank account can become an accounting nightmare when trying to separate business and personal expenses,” said Weidner. “Muddy waters in this area are never welcome when it comes time to file your taxes,” she said. The most common accounting methods used in practice include accrual accounting, which records transactions when they occur rather than when cash exchanges hands. Other common accounting methods include specific inventory valuation methods like FIFO (first-in-first-out) or LIFO (last-in-first-out).

If you’ve never set up a business bank account before, getting started is easy. First, find a bank that offers the best fit for your business needs—even if you already have a relationship with a bank, it doesn’t hurt to consider other options. Your priorities may vary, but consider looking for an account that offers no or minimal bank fees. DIY bookkeeping is simplest when you break it into manageable chunks—don’t try to do it all at once. Even if you opt to use accounting software or hire a professional, use the tips we’ve reviewed in this guide to understand accounting basics. Collecting money in person (at a storefront, marketplace, etc.) can get pricey.